Stop Manual FCRA Filing.

Start Winning Cases.

Satori Legal Lightspeed automates Fair Credit Report Act filing for consumer protection lawyers. AI agents handle document collection, compliance checks, and filing management—so you can focus on your clients.

From Manual FCRA Filing to Automated Compliance

Satori Legal Lightspeed transforms complex consumer protection workflows into streamlined automation.

Automate FCRA Documentation

No more manual tracking of credit report disputes. Satori's AI agents handle document collection, validation, and filing deadlines automatically.

Increase Case Volume

By automating compliance checks and document management, your firm can handle more consumer protection cases without additional staff.

Focus on Winning Cases

Free your team from administrative filing burdens. Satori handles the paperwork so you can focus on building stronger cases for your clients.

How Legal Lightspeed Works

A seamless integration that automates FCRA compliance and case management 24/7.

Case Intake & Monitoring

Satori monitors client communications and automatically collects credit reports, dispute documents, and compliance evidence required for FCRA cases.

Intelligent Document Classification

AI agents automatically identify credit reports, dispute letters, bureau responses, and supporting evidence with smart categorization and validation.

FCRA Compliance Tracking

Track statutory deadlines, required documentation, and compliance milestones automatically. Never miss a critical filing date or evidence requirement.

Secure Case Management

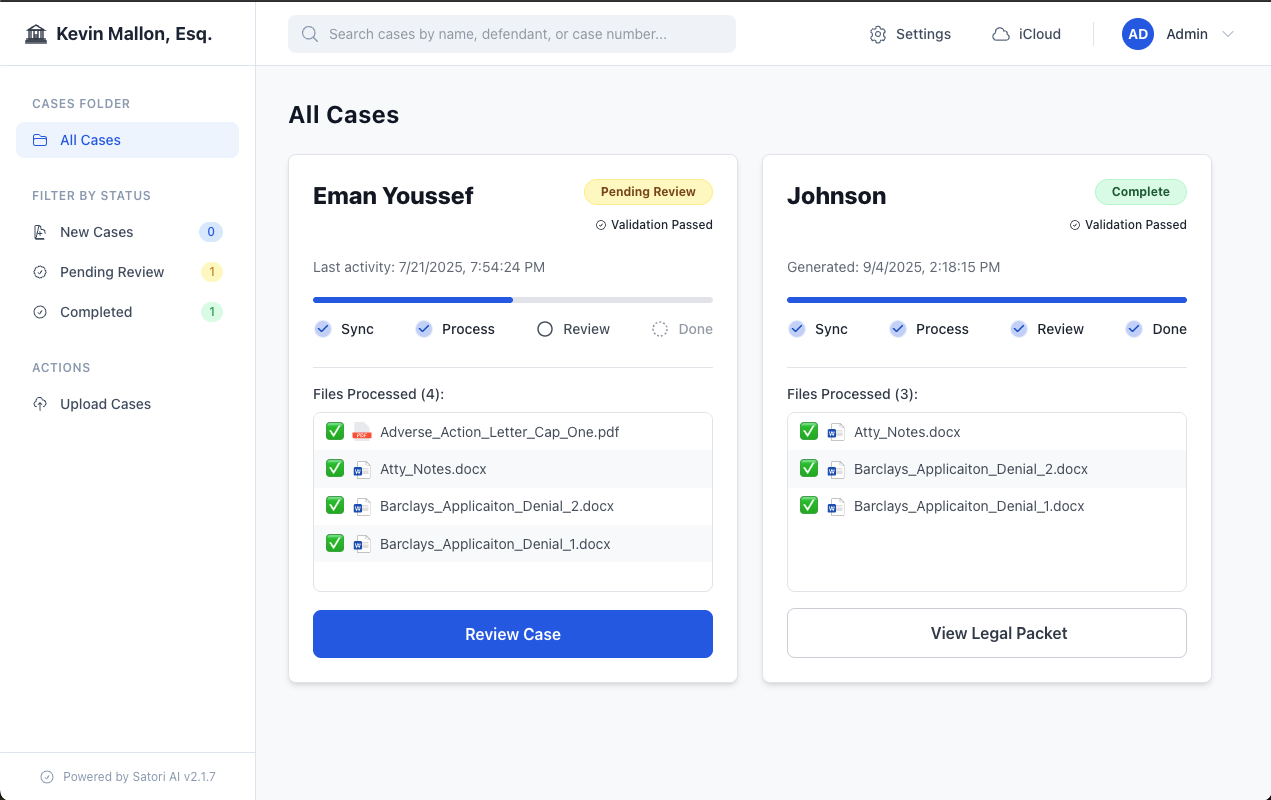

Access your Legal Portal dashboard to see case status, missing evidence, compliance timelines, and automated client updates in real-time.

FCRA Compliance Engine

Document Intelligence

AI-powered classification of credit reports, bureau responses, dispute letters, and supporting evidence

Legal Portal Dashboard

Case management UI, deadline tracking, compliance checklists, automated client communications

Secure Storage & Backup

Encrypted document storage with private Git vault backup for compliance and audit trails

Intelligent FCRA Automation for Consumer Protection Law

Powerful features designed specifically for consumer protection lawyers handling credit report disputes.

Credit Report Analysis

AI agents automatically parse credit reports from all three bureaus (Equifax, Experian, TransUnion), identify disputed items, and track resolution status.

Deadline Tracking

Never miss FCRA statutory deadlines. Automated tracking of 30-day investigation periods, response requirements, and compliance timelines with proactive alerts.

Case Status Dashboard

Filter by case stage (INTAKE, DISPUTE, INVESTIGATION, SETTLEMENT, LITIGATION). Track evidence status, compliance milestones, and client communication history.

Evidence Management

Organize dispute letters, bureau responses, supporting documents, and client correspondence. AI categorization ensures nothing gets lost in discovery.

Document Version Control

Track every version of credit reports, dispute letters, and bureau responses with timestamps. Perfect audit trail for litigation preparation.

Client Communication Automation

Send templated status updates, request additional evidence, or notify clients of bureau responses. Variable interpolation personalizes every message.

Multi-Format Document Parsing

Extract text from PDF credit reports, scanned documents, and bureau letters. AI understands document structure and extracts key information automatically.

Compliance Checklists

Pre-built FCRA compliance checklists ensure every case meets statutory requirements. Custom checklists available for state-specific regulations.

Team Notifications

Slack/email alerts for deadline reminders, bureau responses received, or missing evidence detected. Keep your entire team synchronized.

Security Isn't an Add-on. It's Our Foundation.

In an industry built on trust, your data security is non-negotiable. Satori is a Managed Private Cloud Solution, offering a level of security and isolation standard SaaS products cannot match.

Dedicated VPS Hosting

Your firm's Satori instance runs on its own private virtual server. Your data is never co-mingled with other firms.

Complete Data Isolation

Unlike multi-tenant platforms, your database, files, and configurations are completely isolated, eliminating cross-contamination risks.

End-to-End Encryption

All data, both in transit and at rest, is protected with industry-standard encryption protocols. Your peace of mind is our priority.

Transparent Pricing for Consumer Protection Firms

Scale your FCRA practice with pricing designed for law firms of every size.

Solo FCRA

For the independent professional.

+ $7,500 one-time setup fee.

- 1 User Login

- Up to 50 Active Clients

- Standard Slack Integration

- Dedicated Private Server

Small Firm FCRA

The perfect fit for growing teams.

+ $8,900 one-time setup fee.

- Up to 5 User Logins

- Up to 250 Active Clients

- Full Admin Controls

- Dedicated Private Server

Business FCRA

For established, larger firms.

+ $12,000 one-time setup fee.

- Up to 15 User Logins

- Unlimited Clients

- Priority Support

- Dedicated Private Server

Onboarding includes full setup, training, and CSV import assistance.

Ready to transform your tax season?

Schedule a personalized 30-minute demo and see firsthand how Satori can eliminate document chaos and give your firm back its most valuable asset: time.

Schedule Your Free Demo Today